Be honest – have you been staring at crypto price charts and pulling your hair out? How often do you imagine a hamburger’s worth of investment years ago would have made you a millionaire right about now?

Don’t fall into that trap. Don’t think like the rabbit. Getting rich is a long con but with a little patience and discipline and with math on your side, you’ll be sippin’ margaritas in the Bahamas in no time.

Okay, it will take some years, but at least it’s safe and pretty much guaranteed. So, strap in kiddo, we’re going to get you a yacht.

What’s an ETF?

Exchange-Traded Fund is a pooled investment security that tracks an index, commodity, or some other asset. It can track a price of an individual commodity or a diverse collection of securities.

As the saying goes, diversity is our strength. Well, in the case of stocks that certainly seems to be true. You’ve probably heard of the S&P 500 Index before. Everyone who’s googled “how to become a millionaire by investing” should have.

The logic dictates that if you spread your investment across the 500 best companies across various industries, even if a few have a bad year, some others will have a great one. Others, yet, will have stable growth and so will the total value of your portfolio.

But how does that tie into the coveted crypto growth and amazing potential of blockchain? Is this about buying many different types of coins and hoping one explodes? No. Expand your mind. Think beyond the coins themselves.

Think of the opportunities they create, the industries they affect, the companies that grow thanks to crypto, and more specifically, blockchain. We’ll be hitching our ride to that.

Bitcoin or any other coin can have a good or bad period and that can last a few months, but there is an abstract truth here – coins, in general, are growing and blockchain is a developed technology that is here to stay – and grow. That means that everything connected to blockchain tech will grow.

Can crypto make you rich? Sure. You might get rich if you sink it all into one of the thousands of coins out there. The better question is can the very existence of crypto and blockchain make you rich.

Ain’t she a beaut’? Let’s go get you one of these.

What’s crypto got to do with ETFs anyway?

ETFs are traded on an exchange, just like stocks. Crypto has nothing to do with stocks, right? Wrong. You might not be able to trade crypto on an exchange (right now at least), but you can trade crypto-adjacent stocks.

Crypto ETFs tend to have slower growth than some of the coins some of the time, but that’s fine because slow and steady wins the race. We’re not looking to be a crazed lunatic strapped to a rocket hoping to hit the moon. We’re smooth sailing here.

Think about this. Some crypto is proof-of-work, others are proof-of-stake. Some coins are meme-coins, others are breaking through into “real-life” applications such as e-commerce. All this needn’t worry us one bit. All that matters is that blockchain tech is growing and expanding.

That means that all the companies that accept crypto, work on various aspects of crypto tech, develop crypto, make hardware for computers, etc. are seeing growth.

Advantages and disadvantages

Advantages:

- No hassle – You don’t have to worry about losing your wallet and you don’t even have to know anything about dealing with crypto coins themselves. We are not buying actual coins.

- Tax advantage – ETFs are not subject to a capital gains tax. You get to keep more of your money.

- Less volatile – because ETFs distribute the portfolio across various companies, they tend to be stable.

- Liquidity – because stock exchanges are less volatile than crypto they trade more easily.

Disadvantages:

- Time – The only concern is whether you have the time and patience to invest and keep investing in an EFT and letting it grow.

- Fee – There is a negligible management fee whereas it costs nothing to own your coin.

A millionaire? Really? Does the math add up?

Sure it does. Take out your calculator. No, wait, have this one.

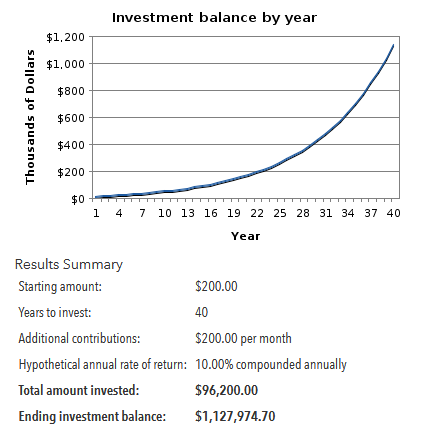

Let’s get into the modest-yet-consistent investment mindset here. Start your portfolio with 200$ and add 200$ from your paycheck every month thereafter. Assume average annual return is 10% which is a fairly modest estimate for crypto ETFs’ performance up to now. Track it across 40 years and hit calculate.

Source: americanfunds.com

Nothing is stopping you from starting with more or adding more and remember, 10% is a fairly conservative estimate compared to $BLOK’s 37% on average in the last 3 years. So which Crypto ETFs are the juicy ones?

Top Crypto ETFs to look out for

- BLOK – Amplify Transformational Data Sharing ETF has over 40 holdings in companies such as Microstrategy, Square, Nvidia, and Paypal. It invests at least 80% of its assets in equity securities in blockchain transactional and mining companies. The expense ratio of this ETF is 0.71%, meaning you pay 71$ for every 10000$ you invest, charged annually. Since its inception it has returned, on average, 26.11% of the investment.

- LEGR – First Trust Indxx Innovative Transaction & Process ETF tracks the Indxx Blockchain Index, which tracks the performance of exchange-listed companies that are using, investing in, or developing blockchain technology. With 100 holdings it is the most diversified of all the EFTs listed here and includes companies like Gazprom PJSC, Intel Corporation, Mastercard, and Salesforce. The expense ratio of this ETF is 0.65%, meaning you pay 65$ for every 10000$ you invest, charged annually. Since its inception it has returned, on average, 11.3% of the investment.

- BKCH – Global X Blockchain ETF is the newest one on the list starting in July 2021. It tracks the Solactive Blockchain Index and so far has 25 holdings, making it a very focused ETF. It seeks to invest in companies that stand to profit from the increased adoption of blockchain technology. Its top holdings include Marathon Digital Holdings and Coinbase. The expense ratio of this ETF is 0.5%, meaning you pay 50$ for every 10000$ you invest, charged annually. It’s hard to tell what the annual return is going to be but the profile for this ETF its selection pool criteria is exciting and there is good reason to think this will be one of the great ones.

Conclusion

Don’t push your luck by buying coins, don’t even diversity your crypto wallet with a bunch of small coins. Go above it all and diversify your approach. Invest into companies that will grow with blockchain tech, as well as other trends and as you saw above – the math adds up.

Take the slow approach and you will be sipping cocktails on any beach you like. Depending on the amount you are willing to invest, even by a very conservative estimate, in 40 years you absolutely will be a millionaire.