The cryptocurrency market proves its relevance and continues to expand. In 2021, the main altcoin Ethereum has surpassed Bitcoin in many ways and has become the main platform for crypto innovation. It was thanks to ETH that the world learned about NFT tokens and the decentralized finance market. TVL of new sectors of the crypto industry accounts for more than 20% of the total market capitalization.

There is no doubt that in 2022 the trend will continue, and NFT and DeFi will reach a new level of development. One of the most promising areas could be the market for decentralized applications. However, a significant problem with any DeFi project is its scalability. And here we smoothly approach the main topic of the article, where we will talk about the Graph cryptocurrency, which can become the basis for moving the decentralized applications market to a new level. We will try to answer the questions: what is graph crypto and why is the graph crypto rising as clear and accessible as possible.

Graph, or GRT for short, is a new generation asset that is basic within the blockchain and even the entire protocol. Crypto algorithms allow you to process requests for circulation in the Ethereum network and IPFS. In short, Graph is a tool that provides easy and fast access to blockchains and organizes data within them. GRT protocols are used in many decentralized applications to enable operation within the broad web 3.0 ecosystems.

What is Graph?

Graph serves as a kind of bridge between the young but promising market for decentralized finance and applications on the one hand, and different blockchain ecosystems on the other hand. In addition, the asset serves as a kind of component for developers of blockchain projects and ecosystem expansion. The open API and the ability to provide applications with the necessary information from the blockchain make the coin a very important component of the toolkit of any development team. This provides the value of the digital asset and allows it to grow in value and increase its capitalization. As of April 17, The Graph ranks 58th in terms of capitalization with a result of $1.7 billion and a token price of $0.365.

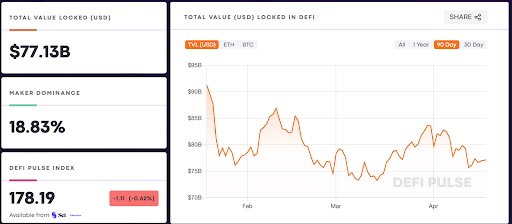

Over the past few months, GRT/USDT has been trading near the key $0.301 support zone. This is primarily due to the current state of the market. The TVL of the DeFi market is in the region of $75 billion, which is a consequence of the bear market. Accordingly, the overall picture suggests that the lack of liquidity in the DeFi sector has affected the price of the token. Among the immediate targets of the asset, it is necessary to note the important level of $0.540, where the two-month resistance level is located. The price continues to be in the consolidation stage, which indicates a weak interest of buyers.

To some extent, The Graph can be called the foundation that ensures uninterrupted communication between various dApps and cryptocurrency services. More than 3.9 billion requests pass through the protocol in one month. The inconspicuous activity of the coin allows us to find out all the available information about a particular cryptocurrency on CoinGecko, Coinmarketcap, or Uniswap. Another important function of the coin can be called the control over the preservation of decentralized data transfer. It is GRT that performs part of the functions for the security and anonymity of information transfer over blockchains.

Graph value for dApp

So what is the GRT crypto usefulness for the decentralized applications market and specific projects? The fact is that due to the activity of cryptocurrency protocols, the networks of specific DeFi projects do not have a single centralized server. In other words, it is a Graph that provides decentralization and complete anonymity of project data on different blockchains. The Graph Network allows the creation of nodes connected by the activities of multiple blockchains, which maximizes data transfer.

For example, let’s take Bitcoin, which has a similar function of anonymity due to its decentralization. But many are waiting for the launch of a spot ETF and trying to figure out how Crypto ETFs will make millionaires. Investors are ready to get rid of anonymity and make transactions through a centralized data source, but at the same time remain protected by a bitcoin investor. Therefore, Graph has a high value only in the DeFi market and its value depends on the growth of demand in the decentralized market.

How does Graph work?

There are several types of users on the Graph network who ensure the operation of the network and earn GRT tokens for their activities:

- Curators can be either users, developers, or members of the DAO community who send signals about the need to carry out operations with certain data arrays.

- Indexers are operators who “accept checks” in GRT for using the protocol’s services.

- Delegators are users who want to participate in the Graph Network’s data transfer processes but prefer to delegate their functions to indexers. For this, they receive certain dividends.

- Consumers are those users, for whom everything was started. They are the end customers who pay commissions and fees to everyone else on the Graph show.

To ensure the economic security of the Graph network, a special GRT token was created. Coins are used as a means of payment for services provided by the Graph Network. As with most applications, the price of a token depends on the value of the services provided. As Graph grows and increases the number of users and turnover, the project plans to bring a ready-made multi-blockchain infrastructure to the main cryptocurrency market.

It is a clear long-term development strategy that makes Graph an important cryptocurrency with great potential. For example, to attract new users, the project introduces a mechanism for indexing rewards. Indexing rewards will start at 3% per annum. The future monetary policy of the GRT will be determined by an independent technical governing body, which will be installed as we get closer to the launch of the network.

Graph community development

Finally, I would like to dwell separately on the efforts that the project is making to develop the ecosystem and its community. The Graph Network has a bonus pool that will be distributed among community members. This model is similar to the DAO, but unlike the autonomous organization, the prize pool is a separate structural element.

A certain percentage of commissions for requests from the bonus pool is distributed thanks to the Cobbs-Douglas function. This reward feature allows Indexers to receive 100% of commissions contributed as a rebate when Indexers allocate a share in proportion to their share of contributions to the rebate pool.

The combination of unique and sought-after solutions and additional mechanisms for the community explains the growth of the GRT token and the popularity of the Graph Network. Considering that decentralized finance technologies are at the initial stage of their development, there is every reason to believe that in 2022 the Graph project will be able to come close to the top 15 in terms of capitalization by solving key tasks for the development of the huge cryptocurrency sector.